Welcome to the International Foundation’s informational resource on multiemployer plans. The purpose of this page is to describe multiemployer plans and explain their structure and use.

If you are not a member, but would like to receive periodic updates from the International Foundation, register today.

Ask an Information Specialist

Not finding what you're looking for? We'll do the digging for you on any benefits-related topic.

Reach out to an Information Specialist today.

What is a multiemployer plan?

Who is helped by multiemployer plans?

Workers: Multiemployer plans provide benefit security for participants and beneficiaries through pooling of risk and economies of scale for employees in a unionized workforce covered by the plan. They also provide portability of certain benefits and eligibility for those employees who move from employer to employer within the industry covered by the plan. As a result, multiemployer plans often enable eligibility to be transferred from employer to employer or job to job which can avoid interruptions in coverage that would apply without this portability.

Employers: Multiemployer plans also help employers with a union workforce in the affected area and industry by making available coverages on a more economical basis due to a pooling of risk and economies of scale.

Which industries use this type of plan?

What are the advantages of multiemployer plans?

- Mobile employees earn and retain their benefits when working for various participating employers.

- Centralized administration increases benefits and/or reduces participating employer costs.

- Risk and resources are pooled.

- The operation and administration functions are transferred to persons or firms specializing in those areas.

- Experienced trustees and administrators reduce administrative costs.

- Self-funded multiemployer health plans provide uniform administration through the preemption of burdensome state and local mandates.

- Stabilized benefit costs among participating employers reduce competition for workers.

- As larger entities, multiemployer plans have access to investment and consulting advice which would be cost prohibitive for smaller plans.

- Negotiated coverages replace complex nondiscrimination tests applicable to noncollectively bargained groups.

- Multiemployer pension plans pay lower Pension Benefit Guaranty Corp. (PBGC) premiums.

- Reciprocity agreements negotiated between multiemployer plans in different geographic locations allow employees covered under their home plan to temporarily work in the jurisdiction of another multiemployer plan and still receive credit for that work. For example, a reciprocity agreement allows an employee in the construction industry to remain continuously employed and to receive benefits even if work in his or her home location is not readily available.

- Benefits are provided tax-free to workers and beneficiaries.

- Employer contributions to multiemployer benefit plans are tax deductible.

What types of benefits can be provided through this type of plan?

Multiemployer plans offer the same types of employee benefits that individual companies provide for their employees, including:

- Health care benefits

- Pension benefits

- Life insurance

- Unemployment benefits

- Accident insurance

- Occupational illness/injury benefits

- Training and education (including apprenticeships and educational scholarships)

- Pooled vacation, holiday and severance benefits

- Financial assistance for housing

- Child care centers

- Disability/sickness insurance

- Legal services

How many multiemployer pension plans are in existence? In terms of assets, how extensive are multiemployer plan holdings? How many participants are covered by multiemployer plans?

As of 2021, there were:

- 2,420 multiemployer pension plans (1,355 defined benefit pension plans and 1,065 defined contribution pension plans) (Note: In many cases, a multiemployer defined contribution plan is offered as a supplement to a defined benefit plan, rather than as a replacement plan.)

- 16,103,000 participants and beneficiaries in multiemployer plans (11,377,000 in defined benefit plans and 4,726,000 in defined contribution plans)

- $952 billion in assets held by multiemployer plans ($717 billion in defined benefit plans and $234 billion in defined contribution plans).

Source: Private Pension Plan Bulletin, 2021 data, U.S. Department of Labor, September 2023.

How many multiemployer welfare plans (i.e., non-pension plans) are in existence? How many participants are in this type of plan?

As of 2021, there were:

- 1,513 multiemployer health plans (53 "health benefits only" plans and 1,460 "health and other benefits" plans)

- 5,160,000 participants in multiemployer health plans (149,000 participants in "health benefits only" plans and 5,011,000 participants in "health and other benefits" plans)

Source: Group Health Plans Report, 2021 data, U.S. Department of Labor, September 2023.

Do multiemployer plans provide retiree medical coverage?

Provision of retiree medical coverage by multiemployer plans is more common than provision of these benefits by individual employers. In a survey conducted in 2024, 50% of multiemployer health and welfare plans provided pre-65 retiree health care benefits and 40% provided health insurance coverage for post-65 retirees.

Source: Employee Benefits Survey 2024, International Foundation of Employee Benefit Plans.

What is a multiple employer welfare arrangement (MEWA)? Is this the same as a multiemployer plan?

Is a multiemployer plan the same as a multiple employer plan or a multiple employer trust?

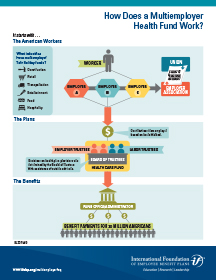

How are multiemployer plans funded?

What is the legal authority for multiemployer plans? What is the legal authority for employer contributions to multiemployer plans and their governance structure?

Multiemployer plans are authorized and defined by ERISA Section 3(37), 29 U.S.C. §1002(3)(37).

The National Labor Relations Act of 1935 (NLRA), as amended by the Labor-Management Relations Act of 1947 (also known as the Taft-Hartley Act), authorizes employer contributions to multiemployer plans and provides the governance requirements for these plans. The NLRA states that employers cannot give money or anything else of value to employee representatives (individuals or unions). The law, however, permits employers to contribute money into a joint trust if it is established for the sole and exclusive benefit of employees and their dependents.

What are the legal requirements under the Taft-Hartley Act for multiemployer plans?

- Employers’ contributions must be held in trust for the purpose of paying benefits to employees and their dependents.

- Only the types of benefits listed in Question 5 above can be provided.

- The detailed basis for the employers’ contribution payments to the trust fund must be specified in a written agreement.

- Labor and management must be equally represented in the administration of the joint trust fund, with an established procedure to resolve deadlocks.

- The trust fund must be audited annually.

- A separate trust fund must be established to hold contributions for pensions or annuities. Pension fund money cannot be commingled with welfare fund (e.g., health care, unemployment, disability, vacation) money.